Care you can afford — covered by insurance.

Healthcare should break barriers, not your budget. Check your insurance eligibility in seconds and unlock $25 flat-rate medical or mental health appointments with licensed providers.

How it works

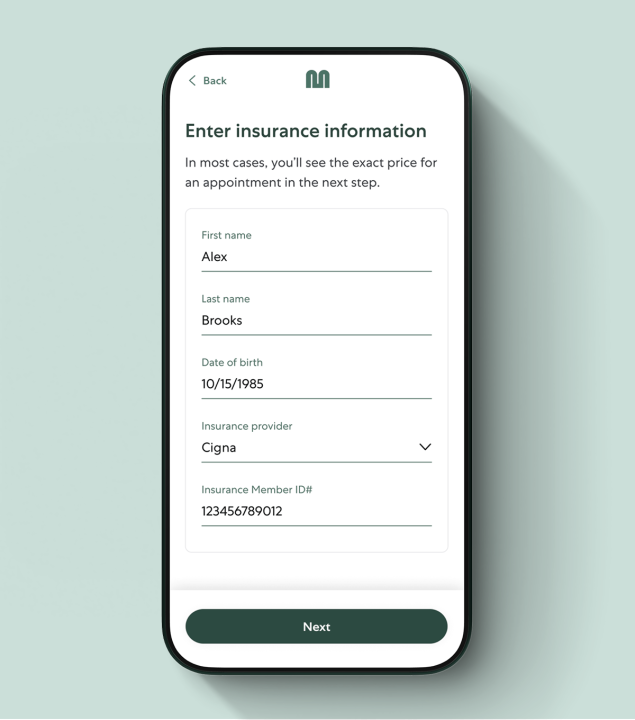

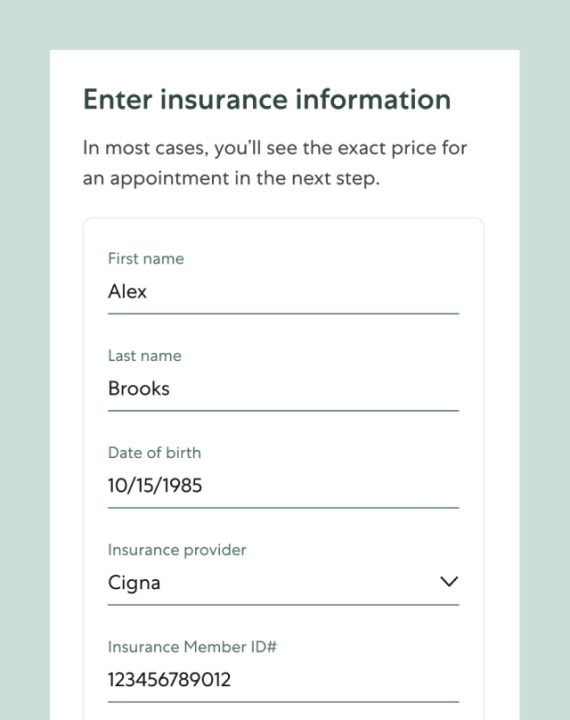

1

Input just your name and date of birth (no insurance card needed most times!)

2

Instantly check your eligibility for $25 appointments

3

Book a one-time or recurring appointment—Find a top-rated doctor or therapist with same-week availability.

We accept most health insurance plans

+ more